Ilmarinen expands its climate targets

Ilmarinen sets climate targets on two new asset classes: corporate bonds and foreign real estate. Plans are already in place for direct listed equity investments and Finnish real estate.

Pension company Ilmarinen is expanding its targets for mitigating climate change: this year, two new asset classes were added to the roadmap published last year.

“Our task is to invest pension assets profitably and securely. It is essential to integrate environmental, social and governance aspects, i.e. ESG aspects, into every investment decision. The risks and opportunities related to climate change are material from the perspective of our investment activities,” says Chief Investment Officer Mikko Mursula.

The new climate roadmap outlines interim targets, key actions and ways to monitor progress. With the help of these, Ilmarinen aims for carbon neutrality in its pension asset investments by the end of 2035.

“Our climate action is based on continuous learning and development. Therefore, we are updating our existing climate roadmaps and creating new ones for specific asset classes,” says Karoliina Lindroos, Head of Responsible Investments.

Corporate bonds

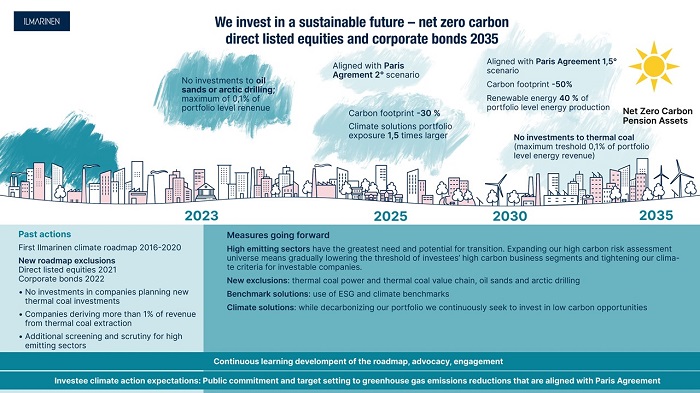

As the value of Ilmarinen’s direct listed equity and corporate bonds investments is almost a quarter of the total pension assets under the company’s management, the portfolio plays an important role in climate action.

Targets:

- Our target is for our portfolio to be aligned with the Paris Agreement’s goal to limit the global increase in temperature to 2 degrees compared to pre-industrial levels by 2025 and to 1.5 degrees by 2030.

- No investments in oil sand or arctic oil exploration by the end of 2023.

- Carbon footprint reduction of 30 per cent by 2025 and 1.5 times more investments in climate solutions compared to 2020.

- The intention is to cut the carbon footprint in half and to increase the share of renewables in energy production to at least 40 per cent by 2030.

- We will exclude coal-based energy production from our portfolio by the end of 2030.

International real estate

The built environment is responsible for more than a third of the world’s energy consumption, representing roughly 40 per cent of total emissions.

“A significant part of Ilmarinen’s international real estate investments are made through real estate managers. Collaboration with the managers and influencing their ways of working is key in implementing the roadmap. We do it on a continuous basis,” says Mikko Antila, Head of International Real Estate.

Initially, the focus of Ilmarinen’s international real estate investments was on office and residential properties in Western Europe and the USA. In recent years, the activity has expanded to cover Asia-Pacific and a broader range of real estate types.

Targets:

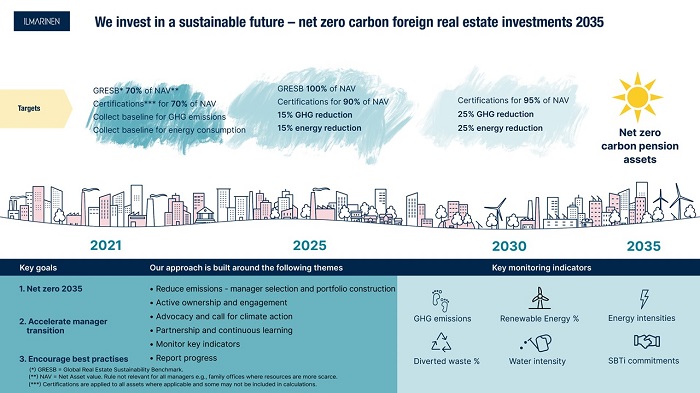

- The Global ESG Benchmark for Real Assets GRESB is a global comparison measuring the sustainability of real estate funds and investment companies on a real estate portfolio level. Our target is to increase GRESB coverage to close to 100 per cent of our investment assets by 2025. In 2021 it was 70 per cent.

- Our target is to raise the share of certified properties to 90 per cent of our investment assets by 2025, to 95 per cent by 2030 and finally to close to 100 per cent by 2035. In 2021, 70 per cent of our properties were certified, based on the value of the real estate investment portfolio.

- Our intention is to reduce the carbon footprint and energy consumption of our international real estate investments by 15 per cent by 2025 and by 25 per cent by 2030.

More information:

Karoliina Lindroos, Head of Responsible Investment, karoliina.lindroos@ilmarinen.fi, tel. 040 577 2203

Niina Arkko, Senior Responsible Investment Specialist, niina.arkko@ilmarinen.fi, tel. 040 703 7614

Current topics

The carbon footprint of Ilmarinen’s investment portfolio decreased significantly

Earnings-related pension company Ilmarinen saw the carbon footprint of its investment portfolio decrease and the share of renewable energy in its investee companies increase significantly in 2023. This information comes from Ilmarinen’s Annual and Sustainability Report 2023.

Ilmarinen’s Financial Statements 2023: Return on investments was 5.8 per cent and cost-effectiveness improved further

Ilmarinen’s return on investments was 5.8 per cent and cost-effectiveness improved further, as premiums written grew 4 per cent and operating expenses financed using loading income fell 5 per cent. Our customers benefit directly from the improvement in our efficiency: we lowered the administrative cost component included in Ilmarinen’s earnings-related pension insurance contribution by 20 per cent as of the start of 2024.

Let’s prepare by saving electricity

A year ago, saving energy, the ‘Down a degree’ campaign and power system support procedure were acute themes as Europe began preparing for a serious electricity shortage. Saving energy still matters.