Large employer’s TyEL contribution

As a large employer, your earnings-related pension contribution is affected by the work ability of your employees, your company’s size i.e. payroll, and the discounts you receive. The fewer people are granted disability pension, the less you pay.

Who is a large employer and what does the TyEL contribution consist of?

In 2024 you are a large employer if your company payroll exceeded EUR 2, 251, 500 in 2022. If your company payroll in 2022 was less than EUR 2, 251, 500 you are a small employer.

The payroll limit of a large employer changes yearly. See the payroll limits for previous years and the known payroll limits for future years on our website.

As a large employer, the size of your TyEL contribution is impacted by how much disability pension has been granted to your employees. This determines which contribution category your company belongs to.

Your insurance contribution is reduced by the client bonus and contribution loss discount.

Read more about client bonuses

Read more about the contribution loss discount

Read more about a small employer’s TyEL contribution

As a large employer you belong to a contribution category

As a large employer you always belong to a contribution category. Which one depends on how much disability pension and partial disability pension has been granted to your employees.

The contribution category impacts the TyEL contribution, more specifically its disability pension component, i.e. the disability pension contribution. The size of your company determines the weight of your contribution category, i.e. how much the contribution category impacts the TyEL contribution.

Contribution category

The more disability pensions or partial disability pensions have been granted to your employees, the higher your company’s contribution category.

There are altogether 11 categories. Contribution category 4 is the base category in which the disability risk corresponds with the average level.

If your company’s contribution category is three or lower, you pay a reduced disability pension contribution. If the contribution category is five or higher, you pay a higher disability pension contribution. Contribution category 4 does not impact the size of your disability pension contribution.

When you take care of your employees’ work ability, you can save significantly on your TyEL insurance contribution.

Read more about improving working ability from Work Ability Hub.

The larger your payroll was two years ago, the more your contribution category affects your TyEL contribution’s disability pension component.

If your payroll in 2022 was at least EUR 36 024 000 your disability pension contribution will be determined entirely based on your contribution category. If your payroll was smaller than this, the contribution category impacts only part of your disability pension contribution. In that case, the remainder is determined based on base category 4, and it does not impact the disability pension contribution size.

The table below shows how your company’s size impacts the size of your disability pension contribution. The larger your company’s payroll, the larger the impact of the contribution category on your disability pension contribution.

| Payroll | EUR 5 mill. | EUR 15 mill. | EUR 30 mill. | EUR 60 mill. | ||||||||||||

| Contribution category | Contribution, 1000 EUR/year | Contribution, % of payroll | Contribution, 1000 EUR/year | Contribution, % of payroll | Contribution, 1000 EUR/year | Contribution, % of payroll | Contribution, 1000 EUR/year | Contribution, % of payroll | ||||||||

| 11 | 55 | 1.1 | 324 | 2.2 | 1 127 | 3,8 | 2 640 | 4,4 | ||||||||

| 10 | 51 | 1,0 | 279 | 1,9 | 930 | 3,1 | 2160 | 3,6 | ||||||||

| 9 | 48 | 1,0 | 233 | 1,6 | 733 | 2,4 | 1680 | 2,8 | ||||||||

| 8 | 46 | 0,9 | 199 | 1,3 | 585 | 2,0 | 1320 | 2,2 | ||||||||

| 7 | 44 | 0,9 | 177 | 1,2 | 486 | 1,6 | 1080 | 1,8 | ||||||||

| 6 | 42 | 0,8 | 154 | 1,0 | 388 | 1,3 | 840 | 1,4 | ||||||||

| 5 | 41 | 0,8 | 136 | 0,9 | 309 | 1,0 | 648 | 1,1 | ||||||||

| Base category 4 | 40 | 0,8 | 120 | 0,8 | 240 | 0,8 | 480 | 0,8 | ||||||||

| 3 | 39 | 0,8 | 104 | 0,7 | 171 | 0,6 | 312 | 0,5 | ||||||||

| 2 | 38 | 0,8 | 91 | 0,6 | 112 | 0,4 | 168 | 0,3 | ||||||||

| 1 | 37 | 0,7 | 79 | 0,5 | 63 | 0,2 | 48 | 0,1 | ||||||||

Example: If your payroll in 2022 was

- EUR 5 million, 8% of your disability pension contribution is determined based on the contribution category and 92% based on the base category in 2024.

- EUR 15 million, 38% of your disability pension contribution is determined based on the contribution category and 62% based on the base category in 2024.

- EUR 30 million, 82% of your disability pension contribution is determined based on the contribution category and 18% based on the base category in 2024.

- More than EUR 36, 024, 000, 100% of your disability pension contribution will be determined based on your contribution category in 2024.

We calculate your contribution category annually. Your contribution category is impacted by the disability pensions and partial disability pensions granted to your employees the year before last and the year preceding that.

Calculating the contribution category is carried out in stages as follows:

- We calculate your company’s pension expenditure for the year before last and the year preceding that based on how much your company has been granted in disability and partial disability pensions.

- Based on the pension expenditure, we define your company’s risk ratios for the years under review. The risk ratio describes how large your pension expenditure was in the year in question compared with the average theoretical pension expenditure of a company of the same size.

- We calculate the category coefficient, which is the average of the risk ratios in the years under review. The category coefficient determines which contribution category your company belongs to in the current year.

The contribution category is specific to the company and pension insurance company. That is why your contribution category is the same in all of your insurance policies at Ilmarinen. If your company has insurance in different pension companies, each pension insurance company calculates a separate contribution category for your company.

This table shows which year’s contribution category is impacted by the years in which your disability pensions were granted.

The years in which disability pensions were granted that must be taken into account in the calculation of the contribution categories for the years 2020–2027

| Year disability pension granted | Impacts contribution category for |

|---|---|

| 2018 | 2020 and 2021 |

| 2019 | 2021 and 2022 |

| 2020 | 2022 and 2023 |

| 2021 | 2023 and 2024 |

| 2022 | 2024 and 2025 |

| 2023 | 2025 and 2026 |

| 2024 | 2026 and 2027 |

Pension expenditure

We calculate your company’s pension expenditure for the year before last and the year preceding that based on how much your company has been granted in disability and partial disability pensions. Pension expenditure always applies to the year in which the pension is granted, i.e. the year during which your employee received the pension decision. The pension contingency, i.e. when your employee fell ill, may have happened even years earlier.

The pension expenditure is the pension liability calculated to the final day of the granting year, with which we prepare to pay your employee disability pension until they turn the lower age for old-age pension or until the pension ends for another reason, for example if the person gets well. This is why the pension expenditure of a single disability pension is primarily impacted by the age of the retired employee and the amount of pension they receive. In addition, the amount of pension expenditure is impacted by how long the time frame is between the pension contingency and the granting of the disability pension.

When we calculate the pension expenditure of your company, only the new, permanent disability and partial disability pensions are taken into account. The calculation of your company’s pension expenditure does not take into account temporary decisions or fixed-term disability pensions, i.e. cash rehabilitation benefits and partial cash rehabilitation benefits.

The pension expenditure also does not include the disability pensions that have been granted to your employees in certain exceptional cases. These exceptions include free-time accidents, rail traffic accidents, patient injuries and, under certain conditions, pensions for persons with impaired functional capacity.

The years-of-service pensions granted to your employees do not impact the pension expenditure nor, as a result, your company’s contribution category. The pension expenditure is also not impacted by the size of your company.

This table shows which disability pensions impact your company’s pension expenditure.

Disability pensions taken into account in pension expenditure

| Factor | Affects the risk ratio | Exceptions | Additional information |

|---|---|---|---|

| Disability pension | Yes | If the person dies in the year the pension is granted (1) or if the pension is granted in the year 2021 or after and its payments have not started by the end of the following year of the year which the pension was granted(2) | (2) If payments of the pension start later, it will be taken into account in the calculation of future contribution categories by the year which the payments started |

| Partial disability pension | Yes | If the person dies in the year the pension is granted (1) or if the pension is granted in the year 2021 or after and its payments have not started by the end of the following year of the year which the pension was granted(2) | |

| Partial disability pension changes into disability pension or vice versa |

No | If the change happens during the year it is granted | |

| Cash rehabilitation benefit | No | ||

| Partial cash rehabilitation benefit | No | ||

| The pension is granted on previous grounds, i.e. the person returns to full-time work from a permanent disability pension but is forced to retire agian on a disability pension on previous grounds |

No | ||

| The pension is left dormant, i.e. the person returns from retirement to full-time work for at most 2 years; after this the right to pension ends |

No | ||

| Pensions ends | No |

The pension expenditure caused by an employee is impacted by the age at which they retire on disability pension, the size of the pension and how long it takes for the disability pension to be granted following the pension contingency. The table shows examples of the amount of pension expenditure for employees of different ages.

| Age | Pension expenditure, EUR |

| 30 | 197,000 |

| 40 | 186,000 |

| 50 | 138,000 |

| 60 | 49,000 |

In the examples, the monthly pension amount is assumed to be EUR 1,000. The examples use 2021 as the pension contingency year and 2024 as the year in which the pension is granted.

The amount of pension expenditure varies depending on how long a period of time elapses between the pension contingency and the year in which the disability pension is granted. There are annual variations especially for younger employees.

We offer our customers the services of our Work Ability Hub, which contains research data, training, support and day-to-day tools to help you in work ability risk management. Read more.

Allocation of disability pension liability between different employers

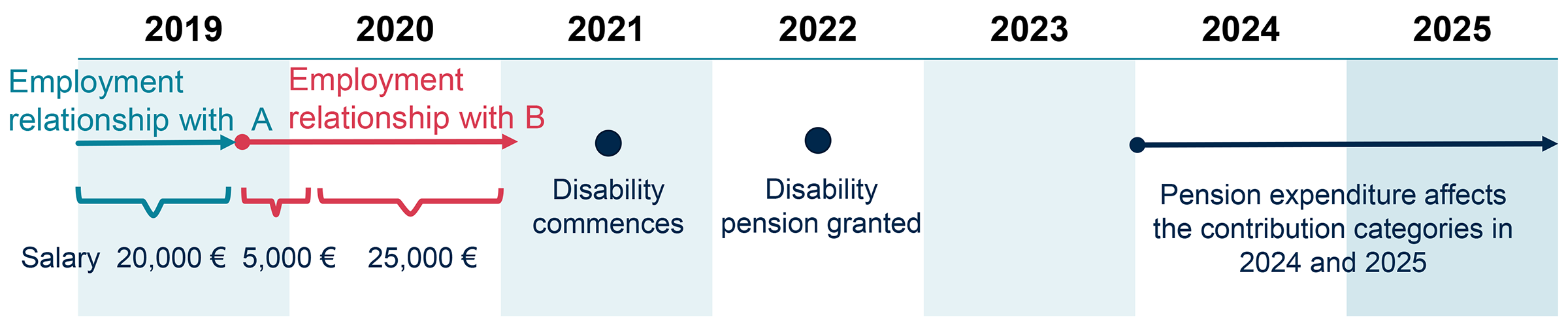

In addition to you, the employee’s pension expenditure and disability pension may also be the responsibility of the employee’s former employers. Whose responsibility the pension expenditure and responsibility for disability pension is depends on the timing of the pension contingency, i.e. when your employee fell ill, leading to a loss of work ability.

If your employee has only worked at your company and did not receive social benefits for illness during the two calendar years preceding the onset of the illness, the pension expenditure resulting from him or her and his or her disability pension are entirely the responsibility of your company.

If your employee also worked elsewhere during the two calendar years preceding the pension contingency or received social benefits during that time, the pension expenditure for your company declines. The pension expenditure is allocated in proportion to the wages or salary paid to the employee to those companies in which your employee worked during the two calendar years preceding his or illness.

If your employee did not work in your company during the two calendar years preceding the pension contingency, your company is not responsible for the pension expenditure or disability pension even if he or she was in your service when he or she was granted a disability pension.

This figure shows an example of how pension expenditure and disability pension liability can be divided up between employers.

Calculation example of allocation of disability pension liability

Pension: EUR 1,000 per month

Pension expenditure EUR 100,000:

- Pension expenditure for A EUR 20,000/50,000 x 100,000 = EUR 40,000

- Pension expenditure for B EUR 30,000/50,000 x 100,000 = EUR 60,000

Pension expenditure affects the contribution categories in 2024 and 2025.

Risk ratio

The risk ratio of your company is your company’s pension expenditure outcome relative to the average theoretical pension expenditure of a company of the same size.

When we calculate your company’s contribution category, we calculate the risk ratios always based on the pension expenditure for the year before last and the year preceding that. In calculating your contribution category for 2024, we have calculated your company’s risk ratios for the years 2022 and 2021.

Category coefficient and contribution category

The average risk ratio for two consecutive years is called the category coefficient. The category coefficient determines which contribution category your company belongs to in the year in question.

When your company’s category coefficient is 0.80–1.19, your company belongs to contribution category 4. If your company’s category coefficient is 1.20 or more, your company’s contribution category is 5 or higher. If the category coefficient is less than 0.80, your company’s contribution category is 3, 2 or 1.

Your 2024 category coefficient and thus your contribution category is based on the average risk ratio for 2022 and 2021.

Check the table below to see how the category coefficient impacts your contribution category in 2024.

Category coefficents and contribution categories in 2024

| Contribution category | Category coefficient, i.e. average risk of ratios for two years |

|---|---|

| 11 | minimum 5 |

| 10 | 4.00 - 4.99 |

| 9 | 3.00 - 3.99 |

| 8 | 2.50 - 2.99 |

| 7 | 2.00 - 2.49 |

| 6 | 1.50 - 1.99 |

| 5 | 1.20 - 1.49 |

| Basic category 4 | 0.80 - 1.19 |

| 3 | 0.50 - 0.79 |

| 2 | 0.20 - 0.49 |

| 1 | less than 0.2 |

Contribution category when circumstances change

The calculation of your contribution category may change if your company’s payroll changes, if you switch pension insurance companies or if your company is involved in an M&A.

If you transfer your company’s TyEL insurance entirely or partially to another pension insurance company, your previous pension insurance company’s contribution category and the information affecting it will transfer along with your insurance.

When you transfer your company’s insurance to Ilmarinen, we will first check whether your company has any insurance with us. If you do, we will review the policies’ information affecting the contribution category calculation and add them up. We then determine your company’s contribution category. This new contribution category will come into effect at the beginning of the following calendar year or starting at the moment of transfer if you change pension insurance companies at the turn of the year.

If your company does not have other insurance with us, we will define your contribution category based on the contribution category information that your previous pension insurance company reported to us.

If you transfer your company’s insurance to Ilmarinen partway through the year, your contribution category will be the same until the next calendar year as in your previous pension insurance company.

Read about how changes in entrepreneurial activities, i.e. M&A:s, impact TyEL insurance >

Administrative cost

From 2023 onwards, your TyEL contribution will be affected by the company-specific administrative cost. Read more about administrative cost.

Discounts

As a large employer, you receive discounts on your contributions. In addition to client bonuses, you receive a contribution loss discount. Read more about client bonuses.

Contribution loss discount

The contribution loss component is one component of the TyEL contribution. This contribution loss component is smaller for large employers than for small employers because large employers have a lower risk of becoming insolvent compared to smaller ones. This discount is called the contribution loss discount. You receive it when you are a large employer and contract employer.

We calculate your company’s contribution loss component and the discount you receive in the manner specified by the employment pension insurance companies’ shared calculation principles. The Ministry of Social Affairs and Health annually confirms the payroll limits that entitle companies to receive a discount and the discount percentages.

The contribution loss discount is a specific percentage of the TyEL earnings you pay. The discount is automatically included in your company’s insurance contributions, which we calculate based on the earnings payment reports you have made to the Incomes Register.

The larger your company, the larger the contribution loss discount. Your size as a large employer is determined by your payroll two years ago. That is why your company’s size in 2024 is determined by your 2022 payroll.

Your final contribution loss discount depends therefore on your discount percentage and the size of your company. Check your contribution loss discount percentage for 2024 in the table below.

| Your company payroll in 2022 | Your contribution loss discount, % of payroll |

|---|---|

| 2,251,500 - 36,024,000 | 0,145 |

| over 36,024,000 | 0,166 |

-

How is the TyEL contribution determined?

The size of your earnings-related pension contribution depends on your size as an employer and the client bonuses you receive.

Read more about determining the TyEL contribution -

Are you unsure about something?

If you require more information on large employer’s TyEL contributions, or other TyEL insurance issues, please contact your contact person or our customer service for large employers. You can reach our customer service for large employers by phone at 010 284 3721 (mpm/pvm) or by e-mail suurasiakasvakuutukset@ilmarinen.fi.

Contact us