Asset diversification and zero interest rates

Diversification across asset classes and geographically is mandatory from both risk management’s and returns’ perspectives. Traditional diversification has faced new challenges in the zero interest rate macro environment over the last years. Financial stability regulation also has a profound effect on high-return diversification possibilities in Finland’s pension system.

The last decade will be remembered as the era of low interest rates and stock market overperformance. Stocks have yielded historically well over a short time period: for instance, one hundred euros invested in the S&P 500 stock index in 2010 would have been as much as 289 euros* in year 2020. Although central banks have lately adjusted their monetary policy strategies, there is no end in sight for the low interest rate era. In addition, the recovery of the stock market from the Covid 19 crisis has been unprecedently swift. The MSCI World index reached its pre-pandemic peak in 140 days – the same trick took 1613 days in the financial crisis**.

The key question for investors is: When does the triumph of stocks end and what then?

Hunt for yield

There is no such thing as a free lunch in the financial markets – and now a gas station sandwich is valued as a five-star Michelin dinner. Let’s add in the rising threat of inflation, uncertainty over the delta variant and central banks’ expanding balance sheets, and we find ourselves in quite a pickle. In terms of asset allocation there are no simple solutions, especially in the current market environment.

Furthermore, financial stability regulation sets a challenging framework for a pension fund’s asset allocation decisions. Finnish pension funds’ investment decisions is cornered by a law, according to which asset classes have been categorized in eighteen different risk categories: the riskier the asset, the larger the capital liquidity requirement. This regulatory framework is vital for a Finnish pension fund’s investment decisions and in terms of capital management.

One has to admit that a pension fund cannot take too many risks because then future pensions might be threatened during market stress. However, the problem is that at the moment future pensions are threatened by the imbalance between pension assets and future’s to-be-paid pensions. Matias Klemelä, the Chief Financial and Risk Management Officer of Ilmarinen, brought up similar worries in his blog earlier in the spring. The current stability framework was established at a time when diversification between rates and stocks was slightly less painful as it is today: not that long ago there was a time when central banks’ interest rate curves did not resemble a dead man’s EKG. This made allocation decisions slightly more straight forward. The highest risk versus return component was derived from stock exposure and the risk balancing factor from rate exposure, adding up some real estate investments and a basket of other asset classes you would have a well performing portfolio in terms of the balance between risk and return.

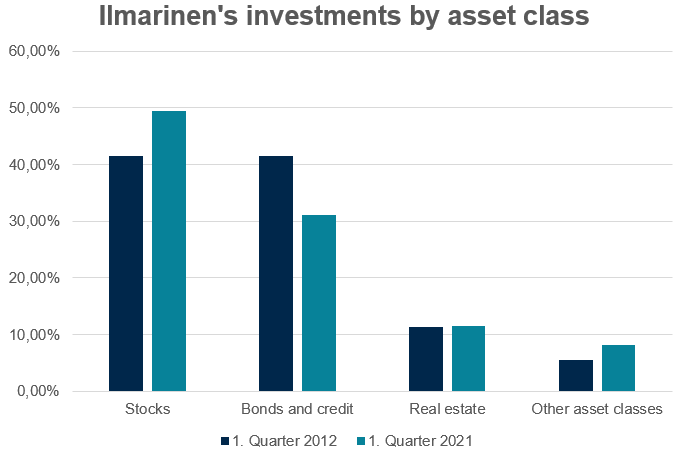

The distribution between Ilmarinen’s investments has changed significantly over nine years. The share of stocks has increased at the cost of rates.***

Internationally recognized pension system is lagging in terms of investment returns compared with international peers

The Finnish pension system is famous for its legitimate equality, stability and predictability. Unfortunately, we are not the best in class as far as real investment returns are concerned, as indicated by the Finnish Centre for Pensions’ report. According to the report, the realized annual return on Finnish pension funds’ investments was 4.4 percent between 2011 and 2020, when the best performing cohorts in Norway, Canada or Denmark reached as high as eight to nine percent returns.

The difference between the international peers and Finnish pension funds is remarkable also in terms of diversification. For instance, due to the regulatory differences between Sweden and Finland, there is a Swedish pension fund whose stock exposure is nearly one hundred percent. This sounds extreme compared with the Finnish pension fund’s stock exposure of forty to fifty percent over the last few years.

These differences in investment returns and asset allocation do not necessarily indicate that investment management in Finland would not be as successful as done by some international peers. The key is that in Finland the financial stability regulation corners Finnish pension funds’ portfolio management which might not be optimal in terms of return optimization. This is the reason why the return comparison between Finnish pension funds and international peers is slightly unjust for Finland.

How to manage the diversification dilemma?

The global economy is momentarily extremely strong despite the rising uncertainty over the delta-variant. This macro landscape gives tail wind for the stock market over the short term. However, there will be the day when global demand truly starts to wind down and the economy cools. In addition, the central banks – at least the Fed in the US – will likely start to tighten their monetary policies by gradually slowing and eventually stopping massive asset purchases and by rising interest rates. This would probably mean the end of the stock rally and the “Hunt for yield” game would appear very different from today.

The financial stability regulation does not make the yield hunt any easier. Although risk-assets have more lucrative expected return, it is not always possible to allocate to these asset classes due to the stability framework. And especially in current market environment a low-risk and high-return investments are extremely difficult to find.

Let us keep our eyes and ears open in the unknown waters of the financial markets.

Elias Järventaus

Junior Analyst at Cross-Asset Allocation, Ilmarinen

B.Sc. Student in Aalto University School of Business, majoring in Economics

@LinkedIn

Elias analyses the macro landscape and financial markets while assisting portfolio managers in their activities. Among his other tasks, he has familiarized himself with the regulatory framework, which is a key element for Finnish pension funds' investment decisions. This is Elias' second summer at Ilmarinen and he enjoys the complexity of cross-asset allocation and the societal relevance of the pension industry.

* Without inflation. Index’s total return between 1.10.2010-31.12.2019.

** Source: Bloomberg and MSCI

*** Source: Quarterly reports: Financial performance - Ilmarinen - Ilmarinen (2012: in Finnish only).

More articles about this topic

Asset diversification and zero interest rates

Diversification across asset classes and geographically is mandatory from both risk management’s and returns’ perspectives. Traditional diversification has faced new challenges in the zero interest rate macro environment over the last years. Financial stability regulation also has a profound effect on high-return diversification possibilities in Finland’s pension system.